Europe's KYC & AML Platform

Built for Speed. Not Spreadsheets.

Automated KYC compliance and AML screening for EU markets. Verify customers in 60 seconds with eID integration, beneficial ownership checks, and real-time sanctions monitoring.

Enterprise Compliance Platform

Comprehensive KYC verification, AML monitoring, and regulatory reporting in one powerful platform

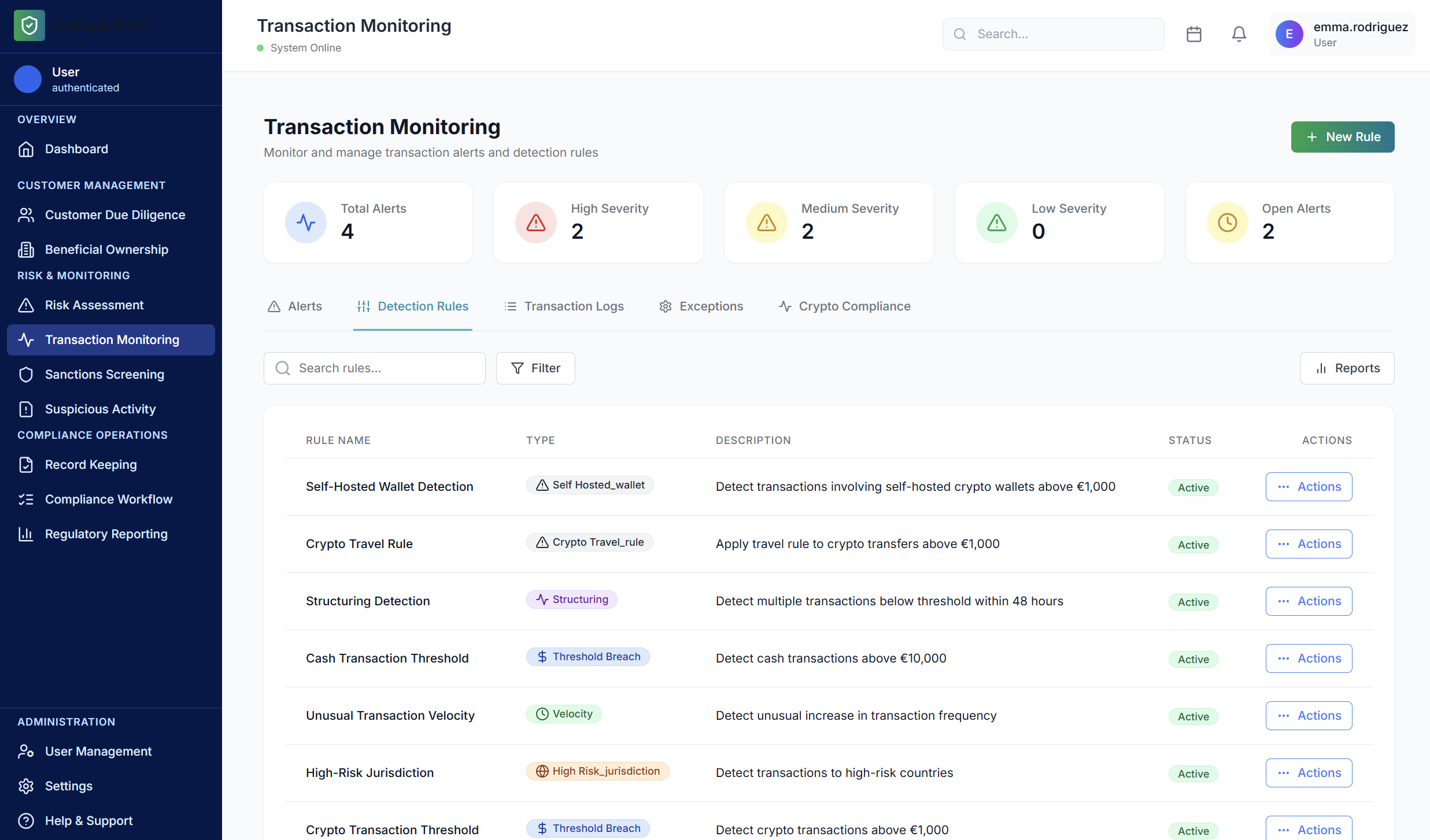

Intelligent Transaction Monitoring

Advanced detection rules monitoring thresholds, velocity patterns, and structuring behavior. Catch suspicious activity before it becomes a compliance issue with AI-powered analysis.

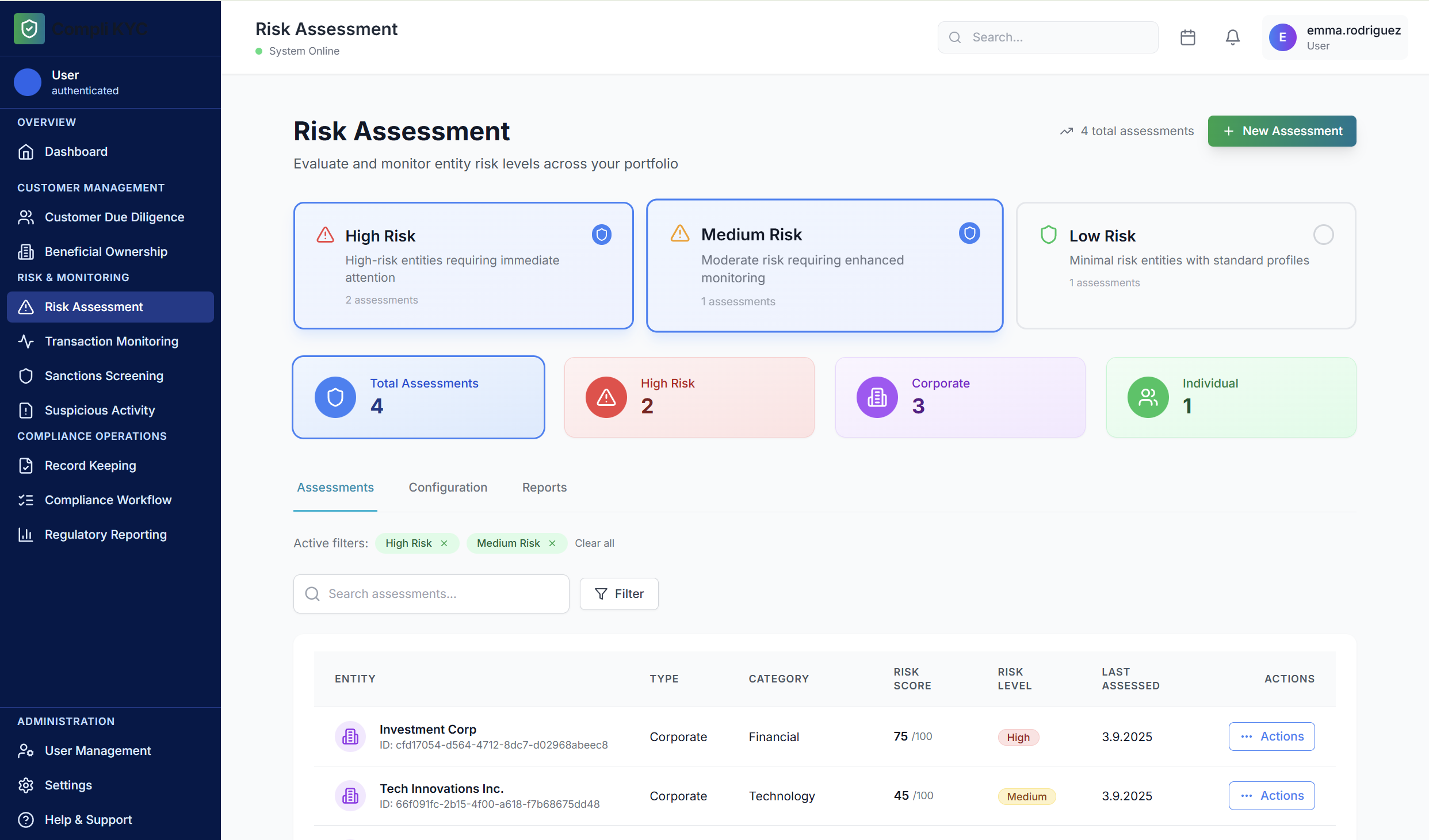

Smart Risk Assessment & Classification

Automated risk profiling with dynamic scoring across multiple dimensions. Classify customers instantly and adjust monitoring intensity based on real-time risk indicators.

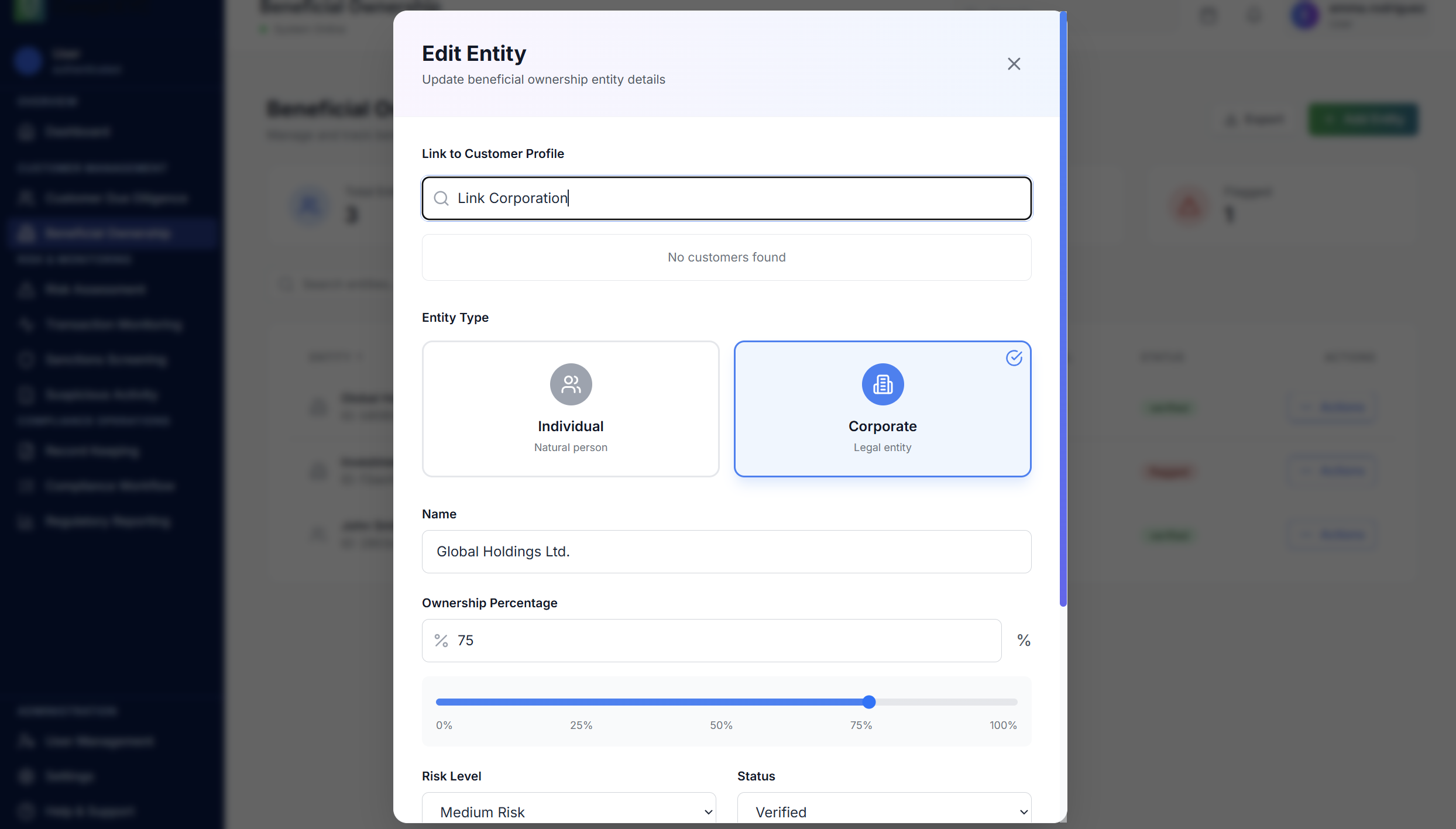

Beneficial Ownership Intelligence

Comprehensive UBO tracking for individuals and corporate structures. Visualize complex ownership chains and automatically identify control persons across multi-tier entities.

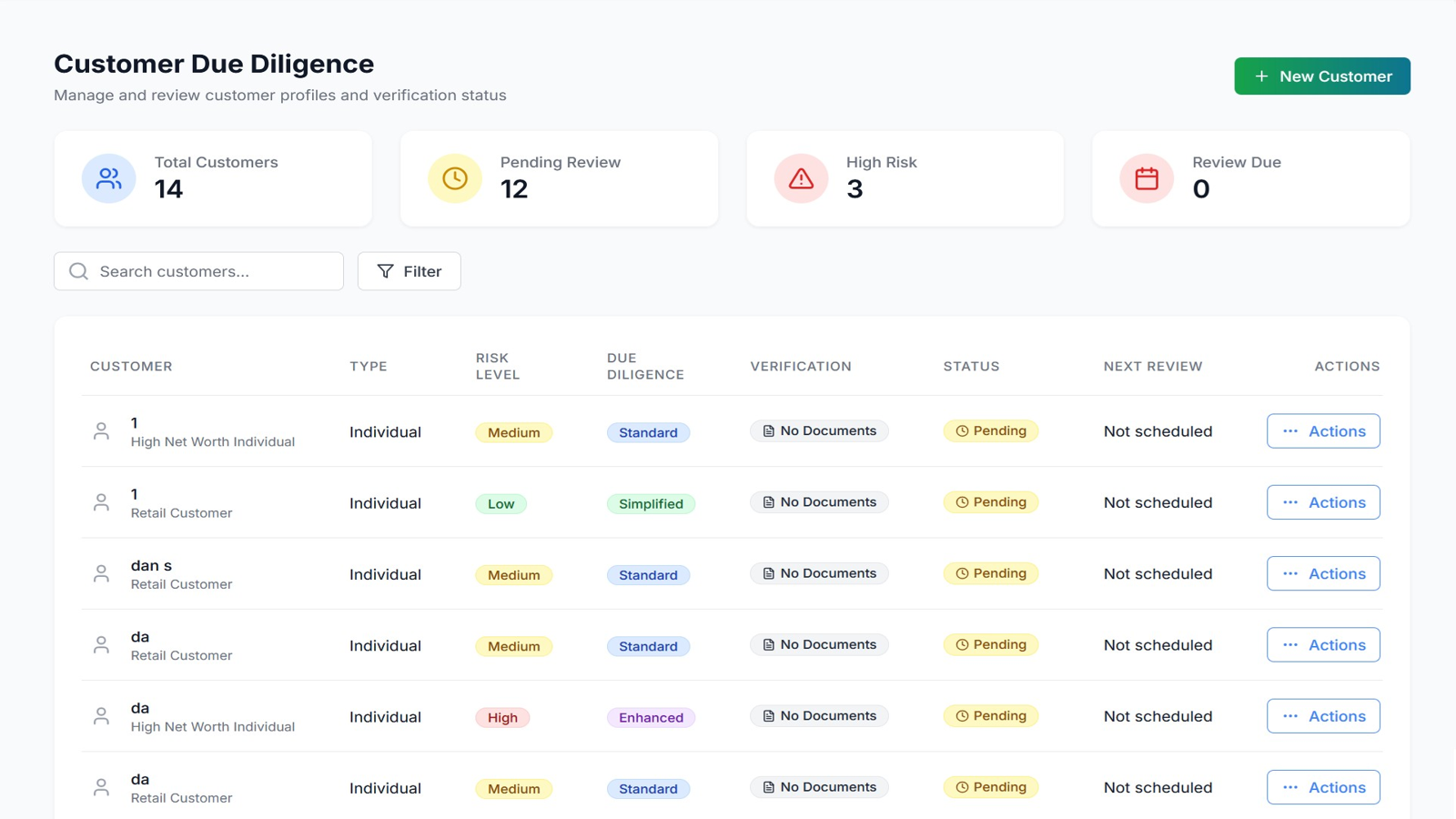

Customer Due Diligence with Smart Profiling

Streamlined CDD processes with intelligent risk profiling. Gather the right information at the right time while maintaining exceptional customer experience and regulatory compliance.

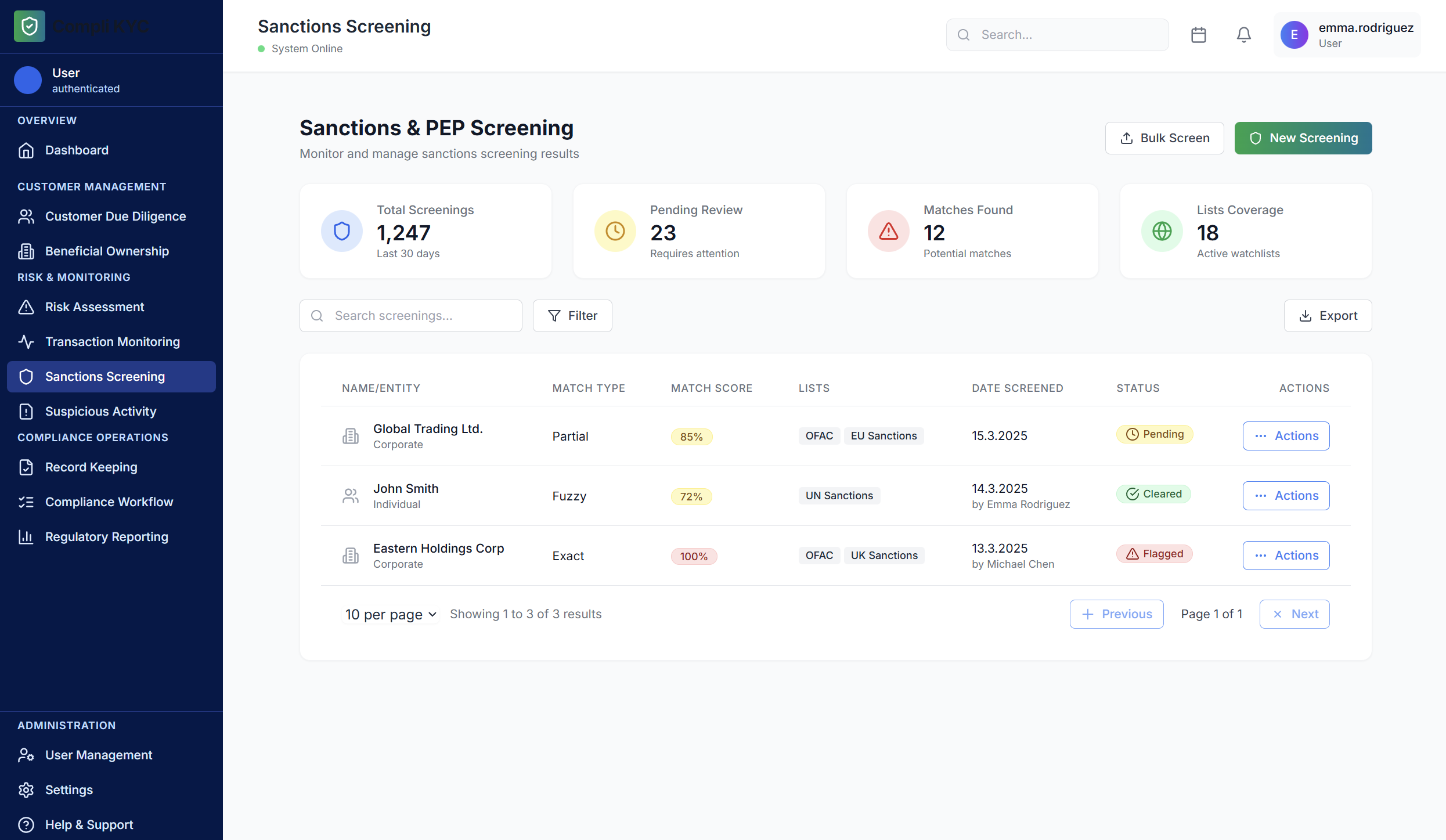

Sanctions & PEP Screening

Real-time screening against 200+ global sanctions lists, PEP databases, and adverse media sources. Get instant alerts on matches with intelligent fuzzy matching to reduce false positives.

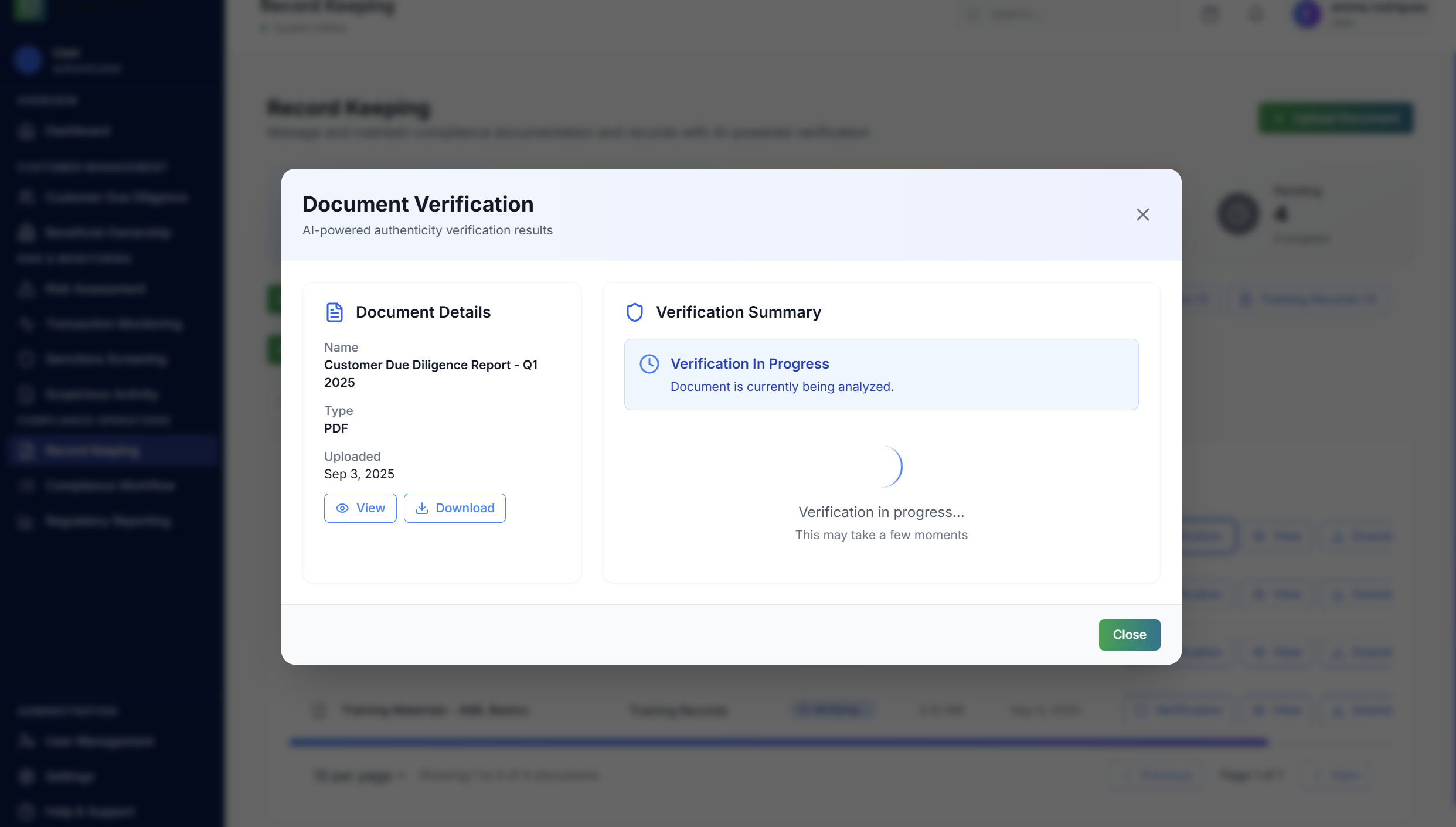

AI-Powered Record Keeping & Verification

Intelligent document management with automated verification and tamper detection. Smart AI validates authenticity, extracts data, and maintains comprehensive audit trails for all compliance records.

The Complete Compliance Arsenal

Everything from instant customer verification to AI-powered transaction monitoring to one-click regulatory reporting. The only platform that covers every EU AMLR requirement without compromise.

Instant Customer Verification

Verify any customer in under 60 seconds with intelligent eID routing across MitID, BankID, and Freja. Automated risk scoring happens in real-time, so you know exactly who you're dealing with before approval.

- Smart eID orchestration across all EU identity systems

- AI-powered document authenticity verification

- Live register lookups with 15+ EU business authorities

- Instant beneficial ownership mapping

- Complete onboarding in 60 seconds or less

24/7 Transaction Intelligence

AI that never sleeps, monitoring every transaction for suspicious patterns, structuring attempts, and velocity anomalies. Catch threats before they become compliance nightmares.

- Real-time monitoring of 100% of transactions

- Behavioral analysis detecting pattern deviations

- Machine learning trained on 10M+ EU transactions

- Dynamic risk scoring that adapts to customer behavior

- Instant alerts to your team when thresholds breach

Zero-Touch Reporting

Generate audit-ready regulatory reports for any EU jurisdiction with one click. Complete audit trails maintained automatically, investigators love our documentation.

- Automated SAR/STR generation with jurisdiction templates

- One-click reporting to all EU financial authorities

- Complete audit trails stored for 5+ years

- Case management with investigation workflows

- Real-time regulatory intelligence and rule updates

AI That Actually Learns

Stop drowning in false positives. Our AI has analyzed millions of EU transactions and knows what real risk looks like. 92% reduction in false alerts means your team focuses on genuine threats.

- ML models trained on 10M+ verified EU transactions

- Region-specific risk patterns for all EU markets

- 92% reduction in false positive alerts

- Continuous learning from your approval decisions

- Predictive risk scoring before transactions complete

EU eID Native Integration

Seamless integration with MitID, BankID, Freja, Finnish Trust Network and all major EU eID systems. Automatic routing based on customer location and availability.

Global Sanctions & PEP Screening

Real-time screening against 200+ global sanctions lists, PEP databases, and adverse media sources. Intelligent fuzzy matching reduces false positives by 85%.

Built for How You Actually Work

Generic compliance platforms force you to adapt to their workflows. We adapt to yours. Whether you're a traditional bank, fast-moving fintech, or crypto exchange—get workflows that understand your specific risks, regulations, and customers.

Traditional Banking

Nordic banks leveraging advanced digital infrastructure and eID systems

FinTech & Digital Banking

Nordic digital banks and neobanks leveraging advanced eID infrastructure

Cryptocurrency & Digital Assets

Crypto exchanges, wallet providers, and DeFi platforms

Real Estate & Property

High-value property transactions and real estate investment

Gaming & iGaming

Online gaming platforms and entertainment services

E-commerce & Marketplaces

Online retail platforms and peer-to-peer marketplaces

Legal & Law Firms

Law firms, legal advisors, and notaries handling client funds and transactions

Accounting & Tax Advisory

Accounting firms, tax advisors, and financial consultants

Investment Advisors & Wealth Management

Independent financial advisors, wealth managers, and investment consultants

Why Leaders Choose Veridaq

Stop juggling five different vendors. Stop drowning in false positives. Stop explaining compliance failures to regulators. One platform that actually works.

One Platform, Zero Gaps

Stop duct-taping five different vendors together. Customer verification, transaction monitoring, sanctions screening, beneficial ownership tracking, and regulatory reporting—all in one seamless system.

92% Fewer False Positives

Your compliance team investigates real threats, not phantom risks. Our AI has analyzed millions of EU transactions and knows what genuine risk looks like. No more alert fatigue.

10x Faster Customer Onboarding

Verify customers in 60 seconds instead of 3 days. Smart eID integration, instant risk scoring, real-time register lookups. Speed that regulators approve of.

Future-Proof Compliance

EU AMLR 2027 compliant today. MiCA ready. TFR prepared. When regulations change, you stay compliant automatically. No emergency updates, no expensive migrations.

Platform Advantages

Deploy in Days, Not Quarters

Modern REST APIs, webhooks for real-time events, SDKs in every major language. Comprehensive docs that developers actually enjoy reading. Go live this month.

Built Your Way

Configure risk rules, approval workflows, escalation paths that match how your business actually operates. No rigid processes forced on you by consultants.

360° Compliance Coverage

KYC verification, ongoing CDD, beneficial ownership tracking, transaction monitoring, sanctions screening, PEP checks, regulatory reporting. Nothing falls through the cracks.

EU-Native, GDPR-First

Your data never leaves the EU. Hosted in tier-3+ data centers with 99.9% uptime SLA. Full GDPR compliance isn't a feature—it's our foundation.

Stop Fighting Compliance. Start Leading Your Market.

Join 500+ European financial institutions who've turned compliance from a cost center into a competitive advantage.

Contact Our ExpertsCalculate Your KYC & AML Savings

See exactly how much Veridaq's KYC Lite and AML Suite can save your business. Most companies reduce compliance costs by 60% or more.

Your Current KYC & AML Costs

Ready to See Your Savings?

Enter your current KYC and AML costs to discover why companies choose Veridaq for massive compliance savings.

Turn Compliance Into Your Competitive Edge

While your competitors struggle with spreadsheets and manual reviews, you'll be onboarding customers in seconds and catching real threats before they escalate. Join 500+ European companies that made the switch.

Customer Verification

Onboard customers in 30 seconds with smart eID integration. 99.8% accuracy, zero friction.

Transaction Monitoring

Catch real threats with AI trained on millions of EU transactions. 92% fewer false positives.

Compliance Reporting

Generate audit-ready reports for any regulator with one click. 5-year trails maintained automatically.

Book a 30-minute demo and see exactly how much time and money you'll save

Book Your DemoExperience Next-Generation Compliance

See why leading companies choose Veridaq for both KYC verification and AML monitoring. Book a personalized demo and discover the perfect solution for your business.

Why Choose Veridaq?

Perfect Solution for Any Stage

KYC Lite for fast-growing companies, AML Suite for complex enterprises. Start where you are, scale when you're ready.

Implementation That Works

Compliance experts and technical specialists ensure your platform goes live smoothly and delivers results immediately.

See Results in Days

Most customers see immediate improvements in processing speed and accuracy within the first week of implementation.